Het arrangement Life on the never-never v456 is gemaakt met Wikiwijs van Kennisnet. Wikiwijs is hét onderwijsplatform waar je leermiddelen zoekt, maakt en deelt.

- Auteur

- Laatst gewijzigd

- 11-05-2025 22:43:26

- Licentie

-

Dit lesmateriaal is gepubliceerd onder de Creative Commons Naamsvermelding-GelijkDelen 4.0 Internationale licentie. Dit houdt in dat je onder de voorwaarde van naamsvermelding en publicatie onder dezelfde licentie vrij bent om:

- het werk te delen - te kopiëren, te verspreiden en door te geven via elk medium of bestandsformaat

- het werk te bewerken - te remixen, te veranderen en afgeleide werken te maken

- voor alle doeleinden, inclusief commerciële doeleinden.

Meer informatie over de CC Naamsvermelding-GelijkDelen 4.0 Internationale licentie.

Aanvullende informatie over dit lesmateriaal

Van dit lesmateriaal is de volgende aanvullende informatie beschikbaar:

- Toelichting

- Deze les valt onder de arrangeerbare leerlijn van de Stercollectie voor Engels voor vwo, leerjaar 4, 5 en 6. Dit is thema 'Money'. Het onderwerp van deze les is: Life on the never-never. Deze les gaat over geld lenen, credit cards, en geld besparen. De grammaticaopdracht gaat over Passive voice.

- Leerniveau

- VWO 6; VWO 4; VWO 5;

- Leerinhoud en doelen

- Engels;

- Eindgebruiker

- leerling/student

- Moeilijkheidsgraad

- gemiddeld

- Studiebelasting

- 4 uur 0 minuten

- Trefwoorden

- arrangeerbaar, credit cards, engels, geld besparen, geld lenen, life on the never-never, passive voice, stercollectie, v456

Gebruikte Wikiwijs Arrangementen

VO-content Engels. (2021).

Life on the never-never h45

VO-content Engels. (2017).

Life on the never-never v456

https://maken.wikiwijs.nl/98867/Life_on_the_never_never_v456

The subject of this lesson is 'Life on the never-never'.

The subject of this lesson is 'Life on the never-never'.

Reading

Reading Grammar

Grammar

Word Idioms

Word Idioms

Song

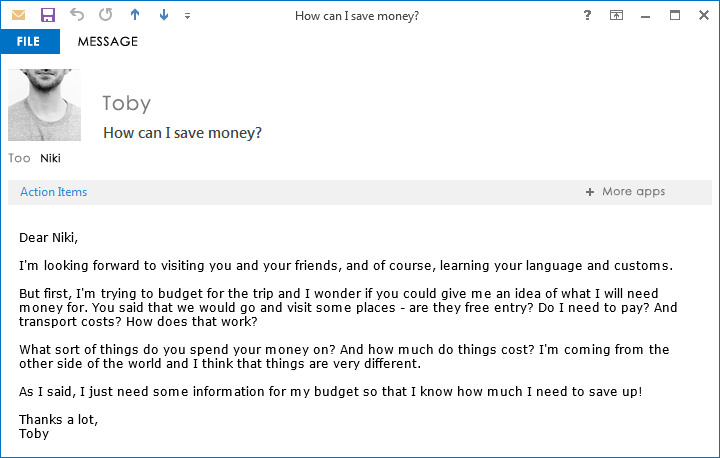

Song Task - Write an informal email

Task - Write an informal email

What have you learned in this lesson?

What have you learned in this lesson?